What Consent letter for GST registration?

A Consent letter for GST registration, also known as a No Objection Certificate (NOC), serves as an official acknowledgment that the property owner has granted permission for an organization to conduct its business activities from their premises. This document is crucial, especially for businesses operating from non-commercial spaces such as homes or properties owned by the business owner.

In many cases, small businesses or startups begin their operations from home to minimize costs before establishing a dedicated commercial office. However, when it comes to GST registration, proof of the business location is required. For businesses operating from their owned premises, proof of ownership of the property like sale deed or index 2 is mandatory during the registration process.

Alternatively, if the business operates from a rented space, a valid rent or lease agreement must be submitted to validate the occupancy. But what if the business operates from a location that is neither owned nor rented? In such instances, taxpayers are required to upload a consent letter along with the proof of the business location such as electricity bill or Property tax bill.

The consent letter essentially acts as a formal declaration from the property owner, stating that they have no objection to the property being used for business purposes. This ensures proper address proof and provides clarity regarding the legitimacy of the business location.

It’s important to note that the format of the consent letter for GST registration is not standardized. It can be any written document that clearly expresses the property owner’s consent for business operations on their premises. This flexibility allows businesses to obtain the necessary permission without being restricted by specific templates or formats.

In summary, the consent letter for GST registration, or NOC, plays a vital role in the registration process by verifying the legitimacy of the business location. When the property is neither owned nor rented, obtaining consent from the property owner is mandatory.

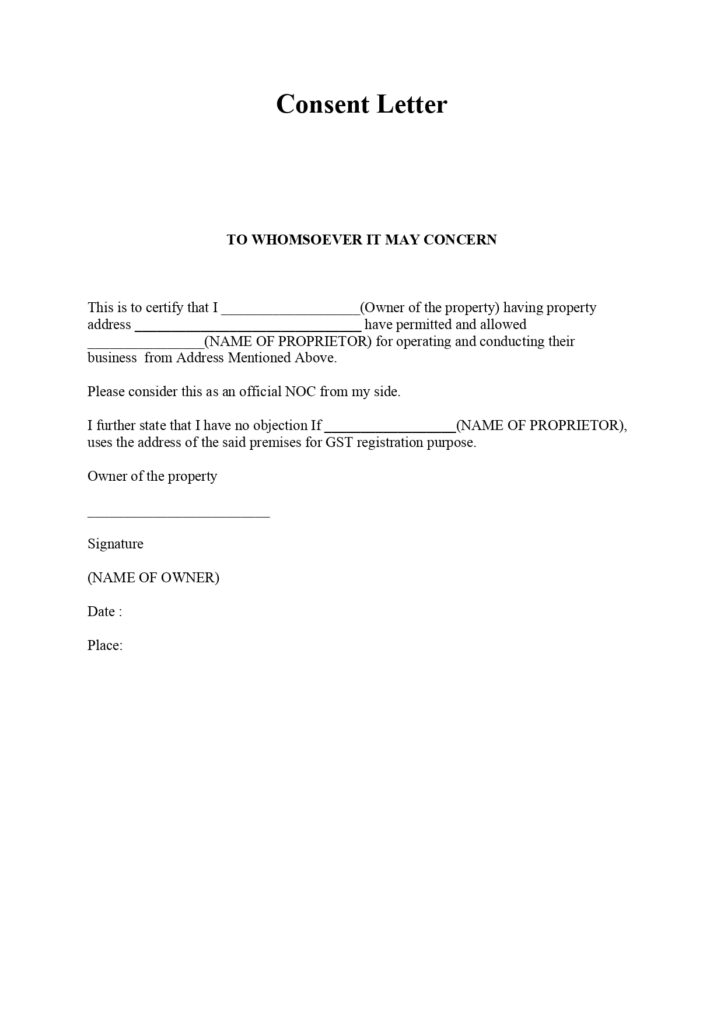

Format of Consent letter

Consent Letter

TO WHOMSOEVER IT MAY CONCERN

This is to certify that I ___________________(Owner of the property) having property address _______________________________ have permitted and allowed ________________(NAME OF PROPRIETOR) for operating and conducting their business from Address Mentioned Above.

Please consider this as an official NOC from my side.

I further state that I have no objection If __________________(NAME OF PROPRIETOR), uses the address of the said premises for GST registration purpose.

Owner of the property

_________________________

Signature

(NAME OF OWNER)

Date :

Place:

Is Notarised Consent letter for GST registration compulsory?

The requirement for the property owner to sign a consent letter for GST registration is a standard procedure to ensure proper authorization for business operations at a particular location. In some cases, GST officers may request the consent letter to be printed on stamp paper and notarized for added authenticity.

When preparing the consent letter for GST registration , it’s crucial to follow the guidelines provided by the GST authorities. While some officers may request the letter to be on stamp paper and notarized, others may accept even a simple printed version. The key is to ensure that the consent letter clearly states the property owner’s authorization for business use of the premises and bears their signature.

If a GST officer specifically asks for the consent letter to be printed on stamp paper and notarized, the taxpayer should comply with the request to avoid any delays or complications in the registration process. This might involve obtaining stamp paper of the required value which varies from to state, drafting the consent letter accordingly, and getting it notarized by a certified notary public.

However, if there are no specific instructions from the GST officer regarding stamp paper and notarization, the taxpayer can proceed with uploading the consent letter on a simple printed version signed by the property owner.

How to upload the consent letter?

Step 1: Access the GST Portal Start by visiting the GST portal and navigating to the ‘Services’ section. From there, click on ‘Registration’ and then select ‘New Registration’. This will lead you to the registration form where you can initiate the process of registering for GST.

Step 2: Fill out the Registration Form As you fill out the registration form, pay close attention to the section titled ‘Nature of Possession of Premises’. Here, you’ll need to select ‘Consent’ if the taxpayer utilizes premises belonging to a relative.

Step 3: Obtain and Sign the Consent Letter Before proceeding further, ensure that the owner of the premises signs the consent letter. This letter serves as official authorization from the property owner, granting permission for the business to operate from their premises. It’s essential to have this document signed to validate the consent provided.

Step 4: Prepare the Consent Letter Prepare the consent letter in either PDF or JPEG format. The content of the letter should clearly state the consent given by the property owner for the business to utilize the premises for its operations.

Step 5: Upload the Consent Letter Once the consent letter is ready, proceed to upload it on the GST portal. Navigate to the appropriate section where documents are required to be uploaded and select the option to upload the consent letter. Remember that the file size of the uploaded document should not exceed 1 MB to comply with the portal’s requirements.

Step 6: Verify and Submit After uploading the consent letter, take a moment to review all the information provided in the registration form and ensure its accuracy. Once you’re satisfied that everything is correct, submit the registration form along with the uploaded consent letter.

What happens if Consent letter is not uploaded?

Neglecting to include the consent letter for GST registration and address proof during the submission of the GST registration application (Form GST REG-01) can result in significant repercussions for the taxpayer. In the event of such oversight, the GST officer responsible for processing the application has the authority to place it on hold until the missing documentation is provided.

When an application lacks the required consent letter and address proof, the GST officer may flag the application and initiate communication with the taxpayer. This communication is typically conveyed through email or phone, informing the taxpayer of the missing documents and the necessary steps to rectify the issue.

Upon receiving notification from the GST officer, it becomes important for the taxpayer to promptly address the deficiency by submitting the required consent letter along with the application. This corrective action is essential to avoid further delays in obtaining GST registration.

Failure to comply with the request for the consent letter may prolong the processing time of the application and potentially result in its rejection.

FAQ

What is a consent letter for GST registration?

- A consent letter for GST registration is an official document where the property owner grants permission for a business to operate from their premises. It is required as part of the GST registration process to validate the legitimacy of the business location.

Who needs to sign the consent letter?

- The consent letter should be signed by the owner of the premises from which the business operates.

Is it mandatory to print the consent letter on stamp paper and get it notarized?

- While some GST officers may request the consent letter to be printed on stamp paper and notarized, it is not a universal requirement. The necessity for stamp paper and notarization may vary depending on the specific instructions provided by the GST officer handling the registration application.

What format should the consent letter for GST registration be in?

- There is no standardized format for the consent letter. It can be in any written document format as long as it clearly states the property owner’s authorization for business use of the premises and bears their signature.

Can the consent letter be uploaded without stamp paper?

- Yes, in many cases, the consent letter can be uploaded without being printed on stamp paper. However, if a GST officer specifically requests it, then the taxpayer should comply with the requirement.

What should I do if a GST officer asks for a consent letter on stamp paper and notarized?

- If a GST officer requests a consent letter on stamp paper and notarized, the taxpayer should follow their instructions to avoid delays or complications in the registration process. This may involve obtaining stamp paper of the required value, drafting the consent letter accordingly, and getting it notarized by a certified notary public.

Is there a deadline for submitting the consent letter for GST registration ?

- The consent letter should be submitted along with the GST registration application. Failure to include the consent letter may result in the application being put on hold until the missing documentation is provided. It’s advisable to submit all required documents promptly to avoid delays in the registration process.